Oregon Coronavirus Recovery Resources

Source: Defazio.House.gov

For the most up-to-date information on what you should know about the coronavirus, state and local updates, and travel advisories please visit the following websites:

- General information – Centers for Disease Control and Prevention (CDC)

- Status in Oregon – Oregon Health Authority

- Travel information – Centers for Disease Control and Prevention (CDC)

- Avoid Coronavirus Scams – Federal Trade Commission (FTC)

For information on filing a new unemployment claim with the Oregon Employment Department, click here.

For a comprehensive COVID-19 resource toolkit, including information on unemployment insurance, food assistance, emergency paid leave, student loan relief and more, click here.

Information On The American Rescue Plan (March 10, 2021)

I am proud that both the House and Senate have passed the American Rescue Plan – it now heads to President Biden’s desk for signature. It’s abundantly clear that families and communities are hurting right now amidst our public health and economic crises. This comprehensive legislation will increase vaccines and testing, provide direct financial assistance to families, extend and expand unemployment insurance for Oregonians who have lost their jobs, bolster funding to allow schools to safely reopen, support small businesses, and finally crush this virus.

To help Oregonians navigate some of the resource that are available to them, you will find information on the following below:

- Direct Relief Payments

- Enhanced Unemployment Insurance

- Vaccine Access and Healthcare Coverage

- Expanding the Child Tax Credit

- Supporting Our Small Businesses

- Safely Reopening Schools and Expanding Childcare Assistance

- Assisting Renters & Homeowners

1. Direct Relief Payments

The American Rescue Plan includes another round of direct cash payments – economic impact payments (EIPs) to provide individuals across the country with more immediate relief.

Each eligible individual will receive a $1,400 EIP, as well as $1,400 per dependent. Thankfully, this legislation finally expands dependents to include those dependents 17 and older – meaning high school juniors and seniors college-aged students – as well as adult dependents. Eligible individuals include any individual in a household with a Social Security Number.

The payments start to phase out for individuals earning $75,000 and will cut off completely for anyone who makes more than $80,000. For couples filing jointly, the phaseout starts for those making $150,000 and cuts off at $160,000.

I know I’ve heard from many Oregonians anxious about when these checks will arrive. While the Internal Revenue Service (IRS) hasn’t said precisely, President Biden has said that the majority of these checks will go out before the end of March, and individuals and families might start seeing checks within a few days or even a week of this legislation being signed into law.

For the most up to date information on direct cash payments, visit the IRS Coronavirus Tax Relief page.

2. Enhanced Unemployment Insurance

Before this legislation, thousands of Oregonians and millions of Americans faced a cliff of expiring unemployment benefits and programs on March 14. I am pleased that this bill extends enhanced unemployment programs through September 6, 2021 and maintains the Federal Pandemic Unemployment Compensation at the current $300 per week.

Critically, it also ensures that the first $10,200 in unemployment insurance for those earning under $150,000 is not taxable – something that I fought hard to include.

I’ve heard from hundreds of constituents who are beyond frustrated by the failures of the Oregon Employment Department (OED) to deliver benefits in a timely manner. I have and will continue to push OED, Governor Brown, and state representatives to do everything they can to deliver benefits as efficiently and effectively as possible.

For more information or assistance for unemployment assistance, you can visit the Oregon Employment Department website.

3. Vaccine Access and Healthcare Coverage

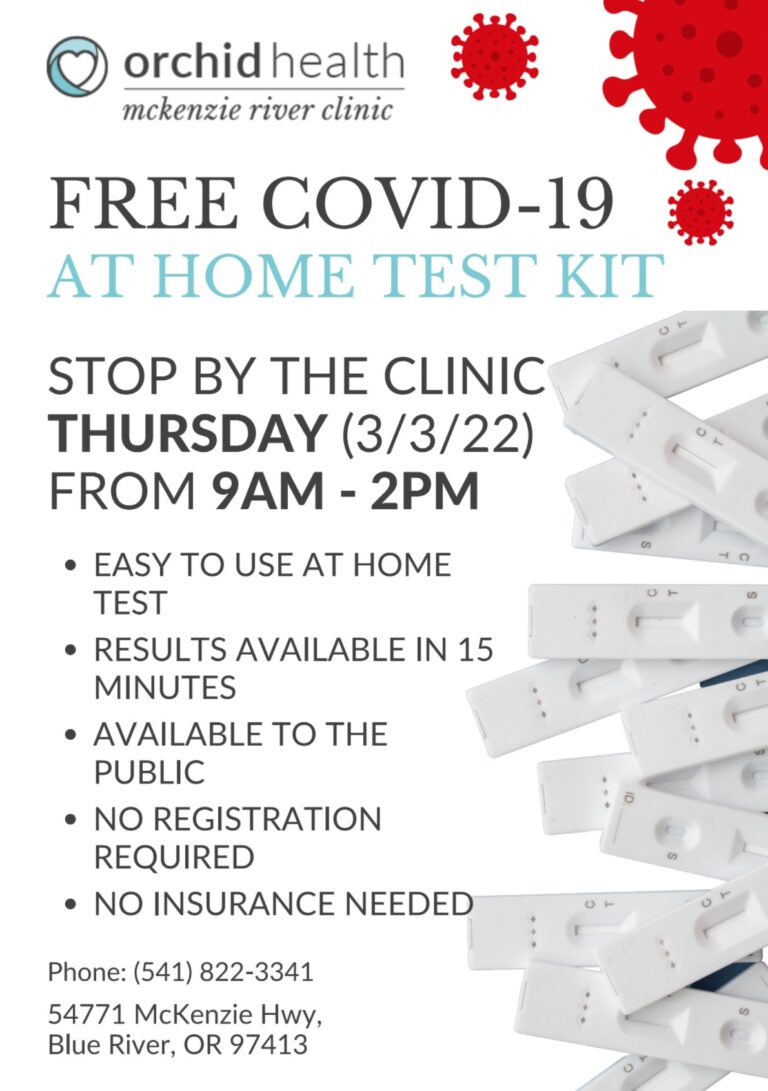

While access to COVID-19 vaccines and testing has steadily increased in Oregon and across the country, more help is needed to ensure all Oregonians have access – no matter where they live – as soon as possible. The American Rescue Plan will make robust investments to accelerate and expand COVID-19 vaccine distribution and testing access Oregon, putting us on a path to eliminate the virus and save lives.

- For more information on COVID-19 vaccines, including eligibility and availability in Oregon, please visit the Oregon Health Authority’s COVID-19 vaccine website. You can also use the state of Oregon’s Get Vaccinated Oregon (GVO) tool to see if you are currently eligible for a vaccine under Governor Kate Brown’s guidelines.

- For COVID-19 vaccination information specific to your county, please visit this page.

- You can also call 211 or 1-866-698-6155, text ORCOVID to 898211, or email ORCOVID@211info.org to find out if you are eligible to get vaccinated.

- You may also want to contact your local public health authority. Contact information can be found here.

The public health crisis has also underscored just how important it is to ensure everyone has access to affordable healthcare. The American Rescue Plan will make healthcare more affordable for low- and middle-income families under the Affordable Care Act (ACA) by reducing premiums, increasing federal subsidies, and placing a cap to ensure no ACA marketplace enrollee spends more than 8.5 percent of their income on healthcare premiums. It will also provide 100 percent COBRA premium subsidies through September 30 for eligible individuals and families who have lost their jobs but would like to remain on their employer-provided healthcare plan.

You can sign-up right now for healthcare coverage at healthcare.gov. Due to the public health crisis, President Biden has opened a special enrollment period allowing individuals to enroll in health insurance coverage through healthcare.gov. The sign-up deadline is May 15.

4. Expanding the Child Tax Credit (CTC)

I am proud that this legislation dramatically expands tax credits for ordinary families. More specifically, this bill makes the Child Tax Credit (CTC) fully refundable for 2021, increases the current $2,000 per-child tax credit to $3,000 per child or $3,600 for a child under age 6.

For 2021, the excess CTC is reduced by $50 for every $1,000 in modified adjusted gross income in excess of $150,000 for joint filers ($112,500 for head of household filers and $75,000 for other filers).

These payments are expected to start in July.

5. Supporting Our Small Businesses

The COVID-19 pandemic has taken an enormous toll on small business, which are the backbone of our economy. That’s why this bill continues to provide relief to help small businesses, ensuring they can keep paying employees and keep their businesses from permanently closing. On top of the hundreds of billions that have been provided through the Paycheck Protection Program (PPP), this bill:

- Provides more than $28 billion to create a relief fund for our local restaurants.

- Provides billions more for the Paycheck Protection Program.

- Provides $1.25 billion for shuttered live venues, on to of the $15 billion provided in December.

In the midst of this crisis, Oregon SBDCs are working in close coordination to share and leverage resources across their network. Throughout this past year, they have assisted thousands of clients, focusing on helping small businesses survive. To access SBDC services, find your local center at bizcenter.org.

For additional information, borrowers can also contact the SBA Disaster Assistance customer service center by calling 1-800-659-2955 or emailing disastercustomerservice@sba.gov. You can also visit www.SBA.gov/disaster for more information.

6. Safely Reopening Schools and Expanding Childcare Assistance

Our students and schools are facing unprecedented challenges due to the COVID-19 pandemic. To safely reopen schools, this package invests nearly $130 billion in school reopenings, including an estimated $1.12 billion for Oregon schools. These funds will help schools address learning loss due to distance learning, keep schools clean, enhance ventilation in schools, and more.

The American Rescue Plan also includes the largest investment in childcare assistance since World War II. The bill provides nearly $40 billion for the Child Care and Development Block Grant program to provide financial assistance to parents and childcare facilities, so that they can keep their doors opens and help parents return to work.

As of March 1, 2020, Oregon has expanded its Employment Related Day Care (ERDC) assistance program. If you are in need of childcare assistance, please visit the ERDC website to learn if you qualify.

7. ASSISTING RENTERS & HOMEOWNERS

This bill provides more than $27 billion for rental assistance. A household may receive up to 18 months of assistance.

- Eligible households are renter households who: (1) have a household income not more than 80 percent of the area median income (AMI); (2) have one or more household members at risk of experiencing homelessness or housing instability; and (3) have one or more household members who qualify for unemployment insurance benefits or experienced financial hardship.

- Assistance is prioritized for renter households with incomes that do not exceed 50 percent of AMI as well as renter households who are currently unemployed and have been unemployed for 90 days.

The bill also provides $9.96 billion to provide direct assistance with mortgage payments, property taxes, property insurance, utilities, and other housing-related costs.

Oregon Housing and Community Services will distribute Emergency Rental Assistance once its available. For information on how to apply for assistance, you can visit their website. The Oregon Homeownership Stabilization Initiative (OHSI) is also accepting application for homeowners with its Mortgage Payment Assistance Benefit, and the deadline to apply is March 14, 2021. For more information and how to apply, you can visit the OHSI website.

For more general information on housing assistance, you can visit the Treasury Department’s FAQ on their Emergency Rental Assistance Program website.

Information On Coronavirus Aid, Relief And Economic Security (CARES) Act (March 27, 2020)

Fact Sheets on H.R. 748, the Coronavirus Aid, Relief and Economic Security (CARES) Act

The Small Business Owner’s Guide to the CARES Act

The Coronavirus Aid, Relief and Economic Security (CARES) Act

Individual Rebates

CARES Act Provisions for Hospitals and Health Systems

Small Businesses and the CARES Act

Rebate Payment Timeline―April 2, 2020

Resources for Small Businesses

Small Business Administration Guidance and Loan Resources

The Small Business Owner’s Guide to the CARES Act

Business Oregon COVID-19 Resources

Small Business Administration Economic Injury Disaster Loans

On March 20, 2020, the Small Business Administration granted a statewide Declaration of Economic Injury for Oregon. This declaration means that the U.S. Small Business Administration (SBA) will offer low-interest loans through the Economic Injury Disaster Loan (EIDL) program for small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). A fact sheet about the EIDL program can be found here.

Applicants can apply online here.

Resources for Unemployment Insurance

Because of the passage of H.R. 748, the CARES Act, more laid-off and furloughed workers than ever before (including self-employed, part-time, gig economy workers, and those new to the job market) will be eligible for Unemployment Insurance. The CARES Act guarantees that each individual will also see an additional $600 per week in their UC check through July 31, 2020.

Oregonians seeking more information on Unemployment Insurance should contact the Oregon Employment Department.

QUESTIONS ABOUT INDIVIDUAL CASH PAYMENTS

Why is Congress proposing to pay rebates to individuals?

The public health and economic consequences of COVID-19 are significant. These rebates help Americans afford what they need during this public health crisis, as many are experiencing a significant cash crunch.

Am I eligible for a rebate and how much will I get?

Everyone who has a Social Security number and whose income is not above a certain threshold is eligible for a rebate payment. This includes Social Security beneficiaries (retirement, disability, survivor) and Supplemental Security Income (SSI) recipients.

Individuals making up to $75,000 ($150,000 for married couples) will receive $1,200 ($2,400 for married couples) with an additional $500 payment per child under the age of 17, up to $3400 per family. Rebates are reduced by $5 for every $100 of income to the extent a taxpayer’s income exceeds $150,000 for a joint filer, $112,500 for a head of household filer, and $75,000 for anyone else (including single filers).

When and how will the rebates be distributed?

For the majority of Americans, the IRS will issue payments via direct deposit using information from your 2019 tax return (2018 if you haven’t filed your 2019 return yet) or 2019 Social Security statement. Treasury Secretary Mnuchin has said that he would like to send payments out within the next three weeks.

If you have not filed a tax return in 2018 or 2019 and do not receive Social Security benefits, the IRS recommends filing a 2018 return to receive payment.

The IRS does not have my bank account information. How will I get my money?

If the IRS does not have your bank account information, you should look for a letter from the IRS within the next two weeks detailing how to receive your payment. They’ll send a phone number and appropriate point of contact so you can tell them if you didn’t receive it. If you’ve moved recently, notify the IRS as soon as possible.

Do the rebates need to be repaid? Are they taxable? Will they affect my eligibility for means-tested programs?

No, rebates do not need to be repaid, no, they are not taxable, and, no, the rebate is not counted towards eligibility for federal programs.

Are non-filers eligible for rebates?

Yes. There is no earned income requirement to be eligible for a rebate, but non-filers may need to take additional steps to receive their rebates.

I’m a college student. Will I receive a check?

If you are claimed as a dependent on another tax return, you’re ineligible. But if you’ve been working and filing taxes independently in recent years, you may qualify.

Student Loan Relief

The CARES Act provides multiple benefits for your student loans in order to help borrowers impacted by the COVID-19 outbreak. This includes:

- Deferring payment of your federal student loans during the public health crisis

- Waiving the accrual of interest on your federal student loans

- Halting the garnishing of wages, Social Security benefits, and tax refunds for student loan debt collection

All loans owned by the U.S. Department of Education (ED) are eligible for these benefits through September 30, 2020. That includes Direct Loans, as well as Federal Perkins Loans and Federal Family Education Loan (FFEL) Program loans held by ED. The Department of Education will remind borrowers in August that payment will resume at September’s end.

Please note that some FFEL Program loans are owned by commercial lenders, and some Perkins Loans are held by the institution you attended. These loans are not eligible for this benefit at this time.

If you are pursuing Public Service Loan Forgiveness (PSLF), you may already know that you can’t make a qualifying payment for PSLF while your federal student loans are in forbearance. However, the CARES Act makes sure that any federal student loan payments that you skip between now and September 30, 2020, will still count toward the required 120 qualifying payments.

If you can afford to make your loan payments during the COVID-19 national emergency, you may want to continue to do so to pay off as much of your loan as possible while there is a 0 percent interest rate.

Additional questions?

Visit the Federal Student Aid website regarding coronavirus and forbearance info for students, borrowers, and parents.